America is plagued with working-class people living beyond their means--suffocating under the crushing weight of debt that makes their lives complicated & eventually steals their long-term dreams. The stress of such a life far outweighs the benefits of acquiring lots of "stuff" in the short term. It may feel amazing in the moment to max out those credit cards buying everything your heart desires, but eventually the chickens come home to roost. Your credit score is ruined, homes are foreclosed on, wages are garnished & before you know it you're filing for bankruptcy just to be able to keep your own paycheck.

The solution to these problems is to simplify your life. Frugal living. Frugality simply means being sensible about money. That's it. Not cheap or tight, but budgeting your income--whatever it is--and putting a certain amount away as savings each month. Many young (and old) people "spend money they don't have to buy things they don't need to impress people they don't like." This is often a result of not being taught how to manage money at home or in school. We're not born knowing how to handle money, after all. But it's never too late to learn. (Not to downplay the very real problems with the economy or late stage capitalism...wages not keeping pace with cost of living, lack of guaranteed sick leave/vacation time, offensive minimum wages & other uniquely American problems. I'm speaking to readers who have a decent-paying job above poverty level & still can't make ends meet).

|

| Seriously, stop it! |

CHIPPING AWAY AT DEBT

First, let's talk about debt. There are only two kinds that are acceptable for a person who's not living in total poverty: medical debt & student loans. Unless you get a full scholarship or have wealthy family paying for your tuition, you should absolutely go to a school you can afford. Some schools on the East Coast like NYU & Drexel have ungodly high tuition that is most certainly out of proportion to any benefit attending these schools will bring if you're taking out loans to attend. Choosing a regional or Midwest university can ensure a smaller class size & more interaction with department heads while also cutting back on your cost of living and tuition. Most employers don't care where you graduated or even what your degree is IN, so long as you have one. That's the reality. There are some exceptions of course, but they're few & far between. There are work-study programs that will help you pay for the cost of living on campus at various schools.

That brings us to the "unacceptable" type of debt: the credit card variety.

With their promises of endless "rewards," it's easy to get lured into getting a credit card & swiping it any time you see something shiny while shopping...even if you don't have the money for it. Then you max that one out & get another. You'll just pay it off later, right? Wrong. Interest piles up & before you know it, you've got a real problem on your hands. Your credit score is dinged & you owe more than you earn in a month on multiple cards. This is frighteningly common among millennials & Gen X'ers & it reflects poor critical thinking as well as major materialism.

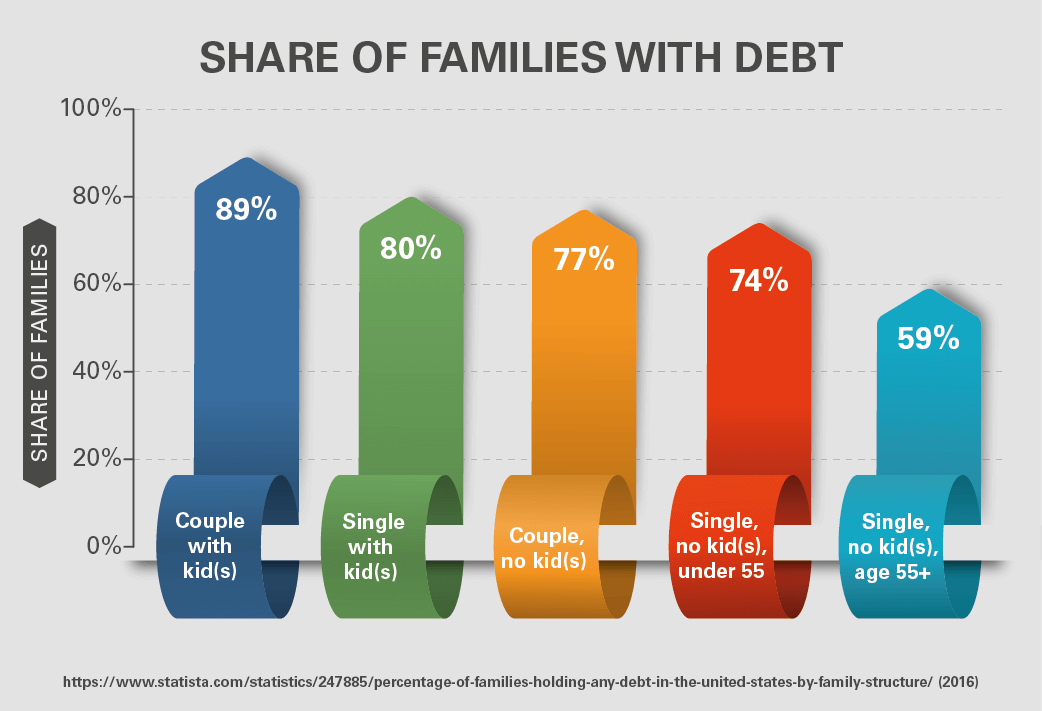

|

| Message: Kids are expensive |

If you're considering getting a credit card (especially in your 20's), I urge you to take a step back & seriously consider your options first. There's a good chance you'll end up using the card to buy "wants" rather than "needs," in which case you should work on developing gratitude & getting enjoyment from for non-materialistic things. This requires work & isn't easy. It might genuinely require therapy depending on how severe your shopping habit is.

Retail addiction is a legitimate problem for a lot of people who feel the need to shop to quell anxiety, fill a void or keep up with the Joneses (or the Kardashians). There's a short-lived dopamine rush that comes from making a purchase that can be as addictive as gambling, sex or junk food. But that rush wears off as soon as you get home with the item, then you're back to Square 1: you still have all the same problems plus less money in the bank. You'll have a better chance of quitting this behavior if you replace it with healthy coping skills like those gained in therapy. Want a quick rush of endorphins in the meantime? Go for a jog at sunset. It's free & will help relieve stress in a healthy way. If your neighborhood or weather aren't conducive to jogging, put on some tunes & dance it out indoors for 20-30 minutes.

WANTS vs. NEEDS

|

| Know the difference. |

Emergencies are a certainty in life; not a "what if". At some point your car is going to break down; you are going to get sick & run up a hospital bill; your bank will make a mistake or some other unforeseen event will happen... Even if you can't predict exactly what the emergency will be, rest assured there will be one. And you'd better have money on hand to cover it when it does.

Learning to distinguish between wants & needs is the first step toward frugal living. "Wants" should be foregone altogether or bought at reduced prices while you should invest more in genuine "needs." After your monthly expenses are covered--rent or mortgage, bills, food, gas & other necessities--you should put as much of the leftover money as you can in savings.

A savings account is ideal because it draws interest on your money while it sits there, but you can also stash cash in a safe or lock box if you prefer. The important thing is not to blow all the money you earn every month on things you don't need because at some point you WILL need something (probably expensive) & the money will not be there. That's how unnecessary debt accumulates--when you can't afford to pay for "needs" because you've already blown your money on "wants". Oh, and if there is a big "want" item that you really desire, it's fine to set some extra money aside for it over time or pick up more hours at work to buy it as long as you don't charge it or overspend.

The solution to becoming financially secure or even wealthy is to similar to the formula for losing weight, except in reverse. With weight loss, you must burn more calories than you ingest. With money, you must save more than you burn each month...at least on those pesky non-necessity "want" items.

WHERE TO SAVE

Focus on investing your money in things that gain or maintain value rather than losing it. No matter how fancy your car is, it starts losing value as soon as you drive it off the lot. Better to buy a "lightly used" car that's in good shape than a brand new one with all the bells & whistles that costs an arm & leg. The same can apply to clothes. Some of the people who live beyond their means can be found on weekends donating their never-worn brand name clothes to Goodwill because they overestimated what they could afford at Bloomingdale's (lol). Ditto for furniture & home decor. It's fine to buy certain things brand new, such as undergarments, but many other items are as good as new from second-hand stores. Antique & thrift stores are another great resource for decorating your space frugally.

|

| 2nd-hand clothes can save you a bundle! |

OTC medications like Flonase, Afrin & sleep aids can be bought on eBay for cheaper than store prices. Just be sure to check the seal & expiration date before buying. Generic versions of OTC medications at Wal-Mart & other retailers are cheaper & just as effective as name brands. Look up the active ingredient in the med you're taking & search for it in the store or online. (i.e. - Instead of "Unisom," look for "doxylamine succinate").

Simple habits like turning off lights when you leave a room or unplugging your electronics when you go to bed can save money over time, both in electric costs & wear & tear on your appliances.

WHERE TO SPLURGE

Some things are cheaper in the long run if you spend a little extra to begin with. The trick is knowing what they are. Shoes are one example of something you should research & spend more on. I'm talking about your main pair you wear frequently for work or other tasks. It's cheaper long-term to buy one quality pair than to buy a cheaper pair that needs to be replaced 2-3x in a year. Choose a sturdy brand that is comfortable & a neutral color to get the most mileage out of them.

|

| Spend more for a better mattress; rest easy |

If you take vitamin or herbal supplements, do your research & choose a brand free of heavy metals & other contaminants. Unlike medications, supplements are not regulated by the FDA so not all brands are created equal. Choose brands that offer third-party lab test results when possible so you know you're getting what's listed on the label. A Google search like "Nature Valley Vitamin D purity" can be pretty revealing. Expensive doesn't necessarily equal better, but it can be one indicator of quality. If you live in a legal weed state, grow your own. This will save you a ton of money if you don't blow too much on lighting & other supplies. (Link 2 my article)

Got some extra "fun" money to spend? Studies show that vacations, concerts & other 'experiences' make people happier overall than buying 'possessions'.

CONCLUSION

Delayed gratification is the central theme of frugal living. You don't have to deny yourself life's little pleasures on account of saving money. If you can work hard & save for something you want, you can have it without feeling guilty. But swiping a card & spending imaginary money for every pretty thing you see is not compatible with an anxiety-free lifestyle. When it catches up to you, the financial woes will make your life a living hell, taking away your independence & freedom so you *can't* have nice things no matter how hard you work. Better to practice self-control now than to have it imposed on you by the banks & credit card companies later. Financial problems due to debt & overspending ruin relationships, contribute to stress-related health conditions like heart disease & have even driven some to suicide. Don't paint yourself into that corner.

.jpg)

.jpg)

No comments:

Post a Comment